By: David A. Altro

B.A., LL. L., J. D., D. D. N., TEP

Owning U.S. Property the Canadian Way Blog Series, Part 2 “The Cross Border Trust – Your Solution for Certain Issues”

November 19, 2019

The solution to the probate problem is something I call the Cross Border Trust (CBT). It takes care of many of the other cross border legal issues, too. Of course, what’s best for you depends on your facts. There is no “one size fits all” solution and nothing is perfect.

Back to our previous case study from my previous blog entry, found here. Pierre and Manon are Canadian citizens both residing in Montreal who recently put an offer on a $500,000 condo in Sarasota, Florida.

If Manon should pass away with title to her Florida condo in what we can call the “Manon Cross Border Trust” there is no probate.

Although Manon passed away, her CBT – established while she was alive – did not pass away with her. Trusts do not necessarily die. Where Manon stated in the CBT that Pierre shall be the beneficiary, he inherits it without the expense, delays and aggravation of Florida probate procedures.

The Structure of the Cross Border Trust

This is a terrific structure. Manon is the grantor (often referred to as the settlor in Canadian terms), owner of the trust, co-trustee and beneficiary in the document known as the CBT Agreement. Her spouse, Pierre, might be the co-trustee, depending on their facts and estate values.

There is no need to hire any outside person or trust company to act as a trustee. Manon and Pierre can do it all by themselves.

Manon has the following powers as the beneficiary:

- She can during her lifetime sell the property, mortgage it, lease it or gift it (subject to Internal Revenue Service (IRS) gift tax rules) without any complications. (If there is a capital gain on sale, the U.S. tax on such gain will be at the lowest rate under the Internal Revenue Code (IRC) – approximately 20% if Manon has owned it at least a year.)

- No Florida state Capital Gain Tax in the CBT.

- Manon has the power to revoke or amend the CBT Agreement any time during her lifetime.

- She is the only person entitled to the income of the assets transferred therein or the capital.

How about these financial breaks?

- No annual filing requirement under the IRC as long as Manon is using the condo as a personal residence and not for rental purposes.

- No filing requirements with the Canada Revenue Agency. Manon doesn’t need an accountant to file any returns.

- No need for the CBT to file any reports, prepare any resolutions or other legal work on an annual basis.

- If Manon already owned it personally and now it has increased in value, it can be transferred into the CBT without triggering any U.S. or Canadian capital gains tax or land transfer tax.

The cost is simply a one-time legal fee to create the CBT.

Transfer of the Property

Manon can establish her CBT while she is in the process of purchasing the property or if she already owns real estate in Florida or another state. So it’s not too late to transfer previously purchased property into her CBT and avoid the probate procedures at court when Manon passes away. One of the many problems with the probate procedure is the obligation of disclosing all the assets of the deceased to a probate court where anyone can access the information.

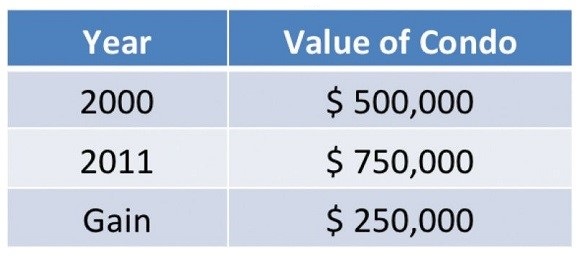

Let’s look at an example:

Tax-Free Rollover

Looking at the values above, will a transfer from Manon’s name to the Manon CBT trigger a disposition and trigger a tax to pay? The answer is, happily, NO. This will be a tax-free rollover. Manon’s cost basis will remain at $500,000 even if the property has a market value of $750,000 at such time.

Since Manon is a Canadian resident, we have to ensure that this plan does not trigger any adverse Canadian tax issues. So we include special clauses in the CBT so that there will be no double tax on capital gains upon a subsequent sale, no deemed disposition upon transfer of the property into the CBT where the property already appreciated when title was in her name personally and no Canadian 21-year deemed disposition rule to deal with in the future.

On the Canadian side, remember that this is a CBT. Accordingly, by specific provisions therein, Manon and Pierre will bypass a standard problem under Canadian trust law. A transfer from Manon to a standard Canadian family discretionary trust would trigger a disposition and capital gains tax.

The CBT is not a standard Florida revocable, living or land trust. Those kinds of trusts cause many problems for Canadian residents. For example, the transfer of the property from Manon to a standard Florida revocable, living or land trust might trigger an immediate deemed disposition and capital gains tax on the gain under the Income Tax Act of Canada.

[1] Excerpt taken from “Owning U.S. Property the Canadian Way, Third Edition” by David A. Altro.

Click here for furhter information

Click here to book a consultation from David A. Altro